Why The Rich Are Rich

1. Understanding Money Is a Tool, Not a Goal

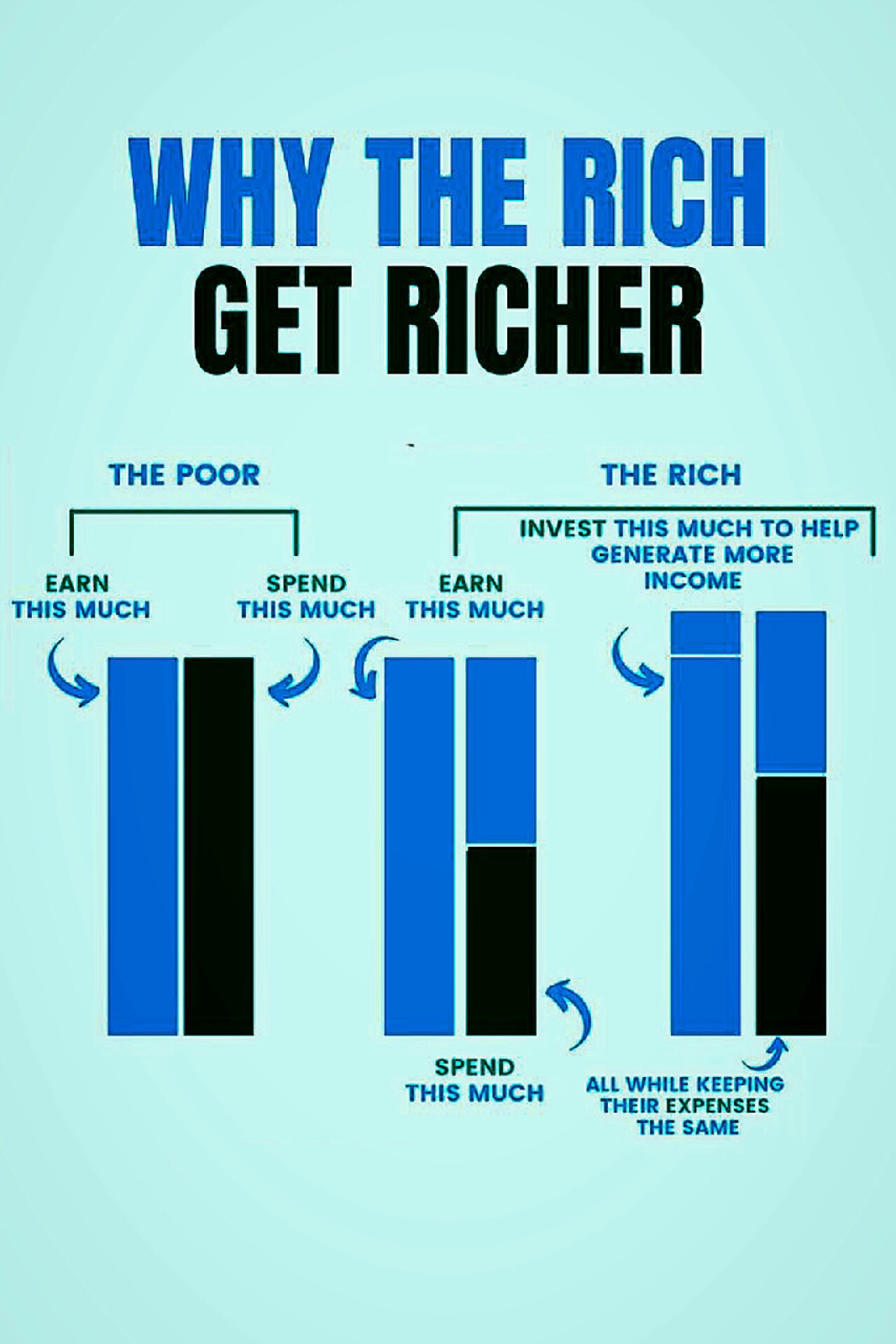

The rich view money as a tool to make more money, not just something to spend.

They understand the power of compound growth (money making money over time).

2. Investing, Not Just Earning

Stock Market: Investing in stocks, ETFs, and index funds to earn returns over time.

Real Estate: Buying properties to earn rental income and long-term appreciation.

Businesses: Building or investing in businesses with high scalability.

Key Tip: Investments provide passive income, meaning they make money without direct effort.

3. Leveraging Debt

Rich people use good debt to make money. For example:

Borrowing to buy real estate or start a business.

Taking loans at low-interest rates to invest in assets with higher returns.

Bad debt (e.g., high-interest loans for luxury consumption) is avoided.

4. Owning Assets, Not Liabilities

They prioritize acquiring:

Businesses.

Intellectual property (e.g., patents, royalties).

Dividend-paying stocks.

Assets increase in value or generate income over time.

5. Building Systems

Rich people don't rely solely on their labor; they:

Create businesses with systems that run without their daily involvement.

Automate finances (e.g., automatic investments, tax planning).

6. Tax Strategies

The wealthy understand tax laws and use them to their advantage:

Investing in tax-advantaged accounts.

Writing off business expenses.

Using trusts and offshore accounts to reduce tax burdens legally.

7. Networking

They form relationships with like-minded individuals:

Partners, mentors, and advisors who open up new opportunities.

Networks can lead to better deals, collaborations, and insider knowledge.

8. Diversification and Risk Management

They spread investments across different areas (stocks, real estate, businesses) to reduce risks.

Insurance protects their wealth against unexpected events.

9. Playing the Long Game

Wealthy individuals focus on long-term growth:

They avoid “get rich quick” schemes.

They understand patience is crucial for compounding wealth.

10. Multiple Streams of Income

They never rely on a single income source. Examples include:

A business.

Rental income.

Dividends and interests.

Royalties or side hustles.

11. Continuous Learning

The rich constantly upgrade their skills and knowledge in:

Investments.

Technology and trends.

Business strategies.

12. Mindset: Growth and Opportunity

They see opportunities where others see obstacles.

Failure is a learning experience, not an endpoint.

Comments

Post a Comment